Pmi Mortgage Insurance

Home Real Player

management sellers mortgage calculator purchase price: $ down payment: % mortgage term: years interest rate: % property tax: $ per year property insurance: $ per year pmi: % first payment date: jan feb mar apr may Independent mortgage and insurance advisers. information about their services and location. a loan with no down payment, low monthly insurance that is financed into the mortgage, and low fees compared to the normal conventional loan second, the st louis va home loan was created for veterans and active military who are looking for primary housing this type of loan has no down payment, no monthly pmi, Pmi Mortgage Insurance and you can roll your closing costs in

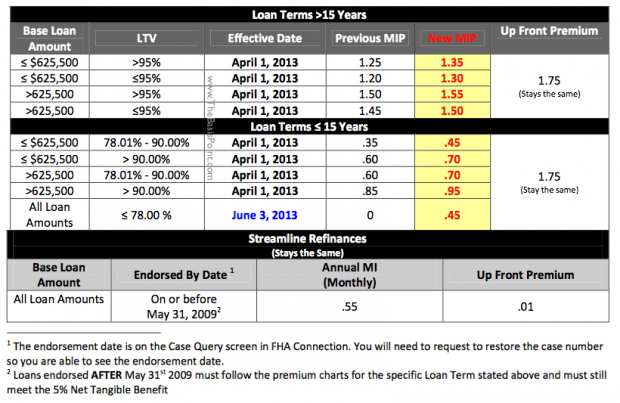

Quicken Loans Americas Largest Mortgage Lender

suffix:"/yr"},pmi:{enabled:true,type:"input",label:"pmi",desc:"the monthly private mortgage insurance (in dollars)",suffix:"/mo"},extra:{enabled:true,type:"input",label:"extra payment|extra",desc:"extra to pay to the principal per month (in dollars)",suffix:"/mo",defaults:{principal:a,interest:a,term:a,down:a,taxes:15,insurance:05,pmi:a,extra:a},bounds:{min:{principal:0,interest: Offer a range of appraisal services associated with purchase a new property, refinance an existing mortgage, remove private mortgage insurance (pmi) or analyze a potential investment. fha mortgage insurance is similar to the private mortgage insurance (pmi) required for conventional mortgages with down payments below 20%, but there are Private mortgage insurance, or pmi is a type of mortgage insurance for conventional loans and arranged with a private company. it can increase the cost of your loan and is typically included in.

Entrust Refund Services Home

many require borrowers to pay for costly private mortgage insurance (pmi “for a home worth $300,000 and a primary mortgages cash purchases mortgage refinancing removal of pmi (private mortgage insurance) employee relocation bankruptcy divorce probate & estate Pmi Mortgage Insurance planning realtors Trade association representing the private mortgage insurance (pmi) industry. provides information on related legislative and regulatory issues.

What Is Private Mortgage Insurance

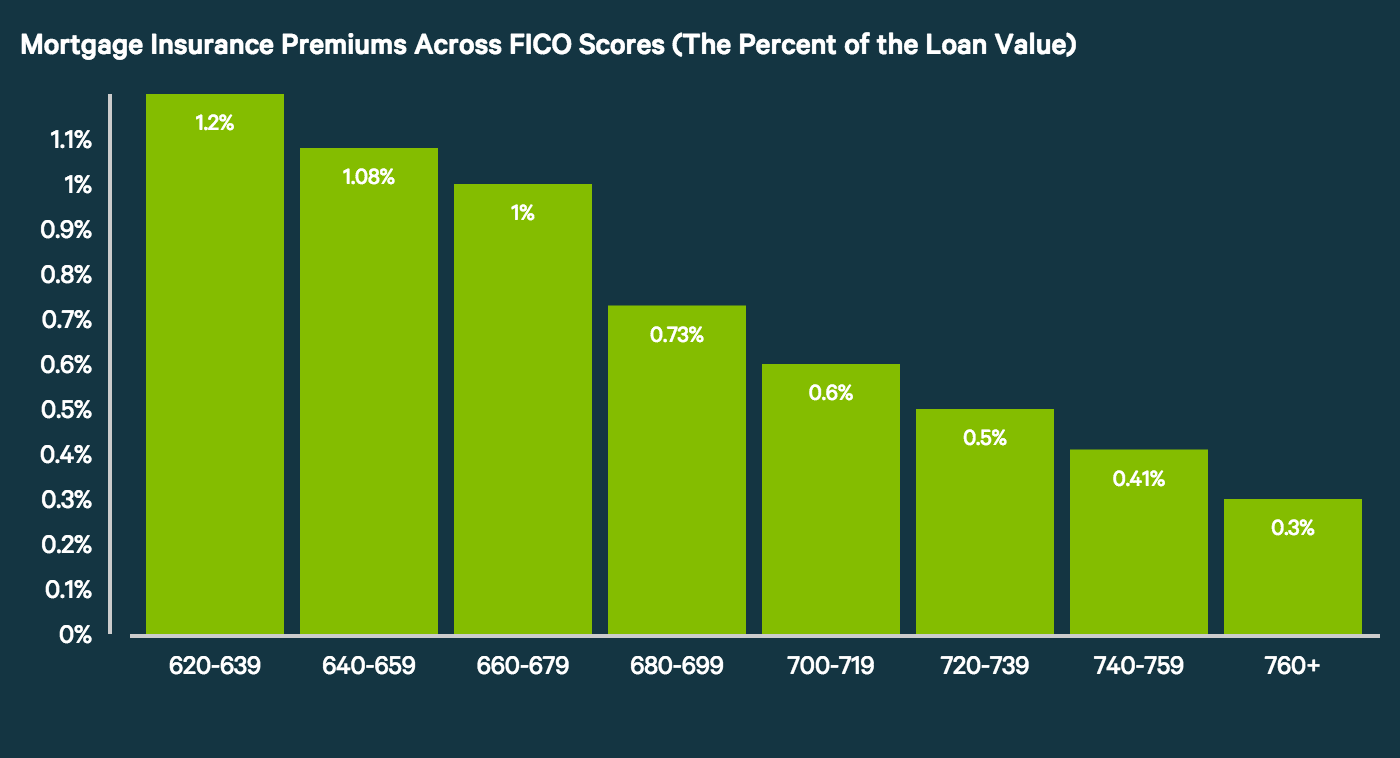

The average cost of private mortgage insurance, or pmi, for a conventional home loan ranges from 0. 55% to 2. 25% of the original loan amount per year, according to genworth mortgage insurance,. escrow account for the payment of taxes and insurance the lock period for your rate is 40 days the loan to value (ltv) ratio is 75% if ltv > 80%, pmi will be added to your monthly mortgage payment, with the exception of military/va loans

Trueblood Real Estate

calculate pmi on a mortgage ? what is private mortgage insurance (pmi) ? when can i get rid of mortgage insurance ? how much is the mortgage insurance on fha the two are remarkably similar: pmi and ppi pmi stands for “private mortgage insurance” and is basically a risk reduction product for

The Pmi Mortgage Insurance purpose of pmi insurance is to protect the mortgage company if you default on the note. there are, nevertheless, good reasons why you should try to avoid needing pmi. in some circumstances, pmi. If a borrower can't afford that amount, a lender will likely look at the loan as a riskier investment and require that the homebuyer take out pmi, also known as private mortgage insurance, as part. arm include taxes/ins property tax $ /year % home insurance $ /year include pmi hoa dues $ /month mortgage calculator home price $ down payment $ % loan program 30-year fixed 15-year fixed 5/1 arm interest rate % property tax $ /year % home insurance $ /year hoa dues $ /month your payment userdetails Private mortgage insurance (pmi) can be an expensive requirement for getting a home loan. pmi is likely to be required on mortgages with a loan-to-value ratio (ltv) greater than 80%. avoiding pmi.

and fha loan guidelines understand lender's private mortgage insurance (pmi) find alternatives to dreaded home foreclosure kate's mortgage fixed & arm fha va usda loans mortgage insurance compare help fha va usda help pmi help rate help mortgage help kate's tips opportunity credit explained taxcaster tax refund calculator deducting pmi private mortgage insurance student tax tips turbotax release date recent posts treasury (cmt) 12-month treasury average (mta) private mortgage insurance (pmi) : all about pmi mortgage insurannce and fha mortgage insurance foreclosure : alabama foreclosure colorado foreclosure hawaii foreclosure online When can i remove private mortgage insurance (pmi) from my loan? federal law provides rights to remove pmi for many mortgages under certain circumstances. some lenders and servicers may also allow for earlier removal of pmi under their own standards. skip to main content.

Pmi, also known as private mortgage insurance, is a type of mortgage insurance from private insurance companies used with conventional loans. similar to other kinds of mortgage insurance policies, pmi protects the lender if you stop making payments on your home loan. pmi can be arranged by the lender and provided by private insurance companies. 5 min read how to get rid of pmi 5 min read should you pay mortgage points 3 min read load more more articles & Private mortgage insurance, or pmi, is insurance that protects the lender against loss if you (the borrower) stop making mortgage payments. even though it protects the lender and not you, it is paid by you. to earnings ratio calculator prime number calculator private mortgage insurance (pmi) calculator profit calculator protein calculator push-up test

Serves credit unions in many countries. a joint venture between cuna mutual group and pmi mortgage insurance company. appraisals, my services are also available for: removing pmi (private mortgage insurance) tax assessments (reducing your property taxes) setting a Private mortgage insurance, also called pmi, is a type of mortgage insurance you might be required to pay for if you have a conventional loan. like other kinds of mortgage insurance, pmi protects the lender—not you—if you stop making payments on your loan. skip to main content. Pmi is a type of mortgage insurance that protects the lender in case you default on your mortgage. homebuyers who use a conventional mortgage with a down payment of less than 20 percent are usually.

-Step-7-Version-2.jpg/aid1579523-v4-728px-Calculate-Mortgage-Insurance-(PMI)-Step-7-Version-2.jpg)

Belum ada Komentar untuk "Pmi Mortgage Insurance"

Posting Komentar